When you’re reviewing the finances for a property, numbers have to be reliable and informative. You have to understand the story of this property from its numbers, spot trouble, and predict the future. When you take the time needed to plug numbers into a spreadsheet, you need to know the calculations are correct and that it gives you a solid indicator to go or not go forward with this property.

When you’re reviewing the finances for a property, numbers have to be reliable and informative. You have to understand the story of this property from its numbers, spot trouble, and predict the future. When you take the time needed to plug numbers into a spreadsheet, you need to know the calculations are correct and that it gives you a solid indicator to go or not go forward with this property.

You also need to share that information. For most of us, we work with partners, and partners don’t want to spend hours figuring out what your spreadsheet means. Simplicity rules the day, but certain details can’t be sacrificed.

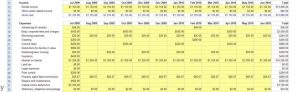

An Underwriting Template is typically just a spreadsheet – Microsoft Excel or Google Sheets. It has been designed in a way that you can enter the numbers you receive from the broker or seller about the property. Your financial docs from the broker/seller will include a Profit and Loss statement and a Rent Roll. While it’s critical to understand how to properly use that information, what I’m focused on is the qualities of your Underwriting Template. Your job is to take the seller’s financials and move that data into your template. Then make a decision based on the results it shows you.

If you are just starting out, look for a highly experienced multifamily educational organization who has a template available, or ask what your friends in your real estate network use. These tools are probably free or inexpensive. Then start practicing with it. Call brokers to have them send property financials, and plug those numbers into your template. Get familiar with every line, every data element, every calculation. When you see a calculation such as total expenses or a return on investment, you should have a good idea of how it was calculated.

Test it out with friends. Show it to them, ask if they can figure out the information, and if they agree with your conclusions. You’ve been looking at it for a long time so just because you understand it now, doesn’t mean someone else will. If they can’t, maybe it’s too confusing.

Try others’ underwriting templates. Look for the differences. One includes a five-year projection and yours does not? One let’s you project rent increases with different scenarios? One includes an Internal Rate of Return? Maybe you want that, or maybe that’s more complexity than you need. Keep it simple.

Or are you comfortable creating your own template? I sure have been, and have made my own. I like it because I can enhance it when I come across new circumstances in the deal that I want to capture so I can see how it impacts the deal. For example, deal structure. I might pay a preferred return, then a percent of cash flow above that to investors and a percent to managers up to another level, and so on. What exactly will an investor make, given a certain amount of cash flow? I need to be able to calculate that. Also what happens to returns if we refinance the loan after a couple of years? I’d like to know that.

But it was much more complex than I could easily explain to even experienced investors and partners. It had to be simplified, and simplifying can be very hard to do.

Whichever direction you go, keep in mind two top-line requirements:

- It has to provide you enough detail and reliable data for you to make a go/no-go decision.

- It has to be readily understandable by your partners.

Find one you like and stick with it but take the time to understand how they work, and look for good ideas from others’ templates.