Our winter in Seattle started off with a power outage. Several days, no electricity. My first thoughts, keeping the house warm but my second thoughts, how do tenants get through something like this.

No place is free of violent storms. My heart goes out to communities hit by hurricanes this year, as many of them can’t even return to their homes or apartments. For us, it was just “just!” a wind storm. Nothing like a hurricane, but it still took the trees down onto the power lines. No matter how many linemen they can recruit into fixing the lines, it still takes days to restore power.

I think of how helpless we are as apartment owners. We don’t have backup generators, let alone enough space heaters to hand out to every tenant. Most owners don’t, especially in Class C properties where margins are low and no other nearby competitors are doing anything similar.

What would we do in such a situation? Some tenants will have relatives they can stay with. Others will prefer to tough it out as the temperature inside drops. But some will need support from property management. Hotels might need to be an option for them, and when power is out for a large area, the less expensive rooms will go quickly.

It is a good idea to check your leases to confirm what you’re required to do. That’s the starting point, but what you should do is often more than what you’re required to do. If it’s an Act of God, does the lease say they’re on their own? That doesn’t mean you don’t try to help. Insurance may help you cover the cost of getting tenants into a safe place, so check your coverage.

A storm shouldn’t bankrupt you as an owner, though. The tenant is not better off when you can’t pay the mortgage and have to give the property back to the lender. You have to protect your financial stability at the same time you are protecting your tenants.

These are not easy decisions but they are easier when you’ve thought through them ahead of time. Sometimes it takes our own personal storm to make us think about crisis scenarios.

Market update

Omaha, NE – What’s drawing so many people moving to Omaha? Something, apparently, as population has grown 35% in the last 30 years to over 1,000,000 residents, over 4% since 2020, including the MSA city of Council Bluffs to the east in Iowa. The big employer is Offutt AFB but the story is the diversity of the employers.

Everybody knows Berkshire Hathway is headquartered in Omaha, home of Warren Buffett, but it’s important to remember that Berkshire is a conglomerate of companies spread out all over the U.S. Total sales, $400 Billion. Total employees, 370,000. Must have a big office in Omaha, right? No, 25 employees.

Omaha undoubtedly benefits from Berkshire being headquartered there, but Berkshire is clearly not the growth driver in Omaha. The top 10 employers include 5 health care organizations, a bank, a railroad, an insurance company, a credit card processor, and Paypal. These are companies that aren’t going away. They’re a very strong backbone supporting the many diverse, vibrant communities surrounding Omaha, and creating the infrastructure that enables business startups and draws new people to town.

That is, renters.

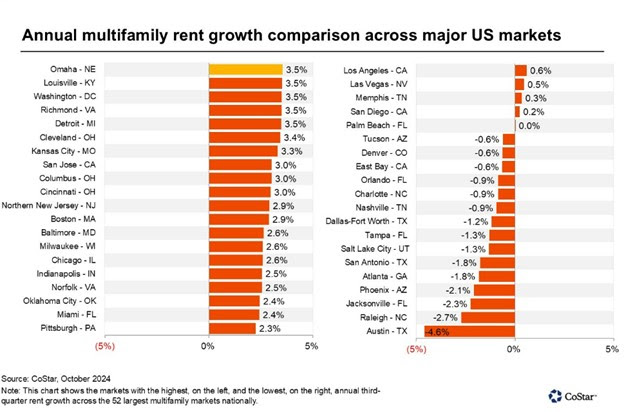

This shows up in rent growth data, which Omaha currently leads in an October Costar report.

Rent growth metrics are always transitory – leaders don’t lead for very long. However, when cities that have long been thought of as top tier rent growth markets are struggling, as they are now, whichever cities are doing well have sustainability. They’re doing things right.

Omaha can also claim a high median household income of $67,000, very strong, and jobs growth averaging 2.3% over the last 12 months. Jobs growth is coming from some great employers – Facebook with a massive data center in the area, Google with a new data center, and Amazon with several fulfillment centers and warehouses. Add to that Omaha’s affordability, with Payscale.com reporting housing costs 16% lower than the national average and overall cost of living 7% lower.

Omaha could use a professional sports team in the major leagues. They have several pro teams in baseball, football, basketball, soccer, and hockey, all extremely well supported by local fans, but none at the NFL, MLB, NBA, MLS, NHL levels. But that could change!

What Omaha offers, and truly a strength that takes generations to build, is its reputation as a quintessential family-friendly Midwest lifestyle. Companies recognize how this translates to stable, hard-working people. They know they’ll find educated, motivated, trainable, and trustworthy people who will stay for the long term.

These are people who will rent apartments as they build their lives, and who will pay on time.

Recent Articles Worth Sharing

Please note, these links might require a login but the accounts are free to create.

Exurbs Emerge as America’s Fastest-Growing Communities

There were more exurbs among the nation’s fastest-growing places in 2023 than in 2019.

Read more

New Freddie Mac Report Basically Says There’s Never Been a Better Time to Invest in Real Estate

According to government-backed housing lender Freddie Mac, there are currently 30 renter households for each house for sale.

Read more

Maximizing Multifamily Management: The Power of AI Systems

Imagine an AI-driven virtual assistant that can recall all conversations with prospects or residents, ensuring they feel understood without the need to repeat themselves.

Read more

Finer Points of Multifamily Properties

Sensitivity Analysis – Proof your Deal Works Even When the World’s Falling Apart

Your underwriting has to tell you if the deal works, and it has to tell your partners it works. Numbers don’t lie. You work hard to plug accurate numbers into your calculations so that you can rely on the results.

Which results do you care about most?

The returns. When will we see cash. How long do we have to hold. How much risk are we taking. It’s all there in the underwriting. You will hit your targets, according to your underwriting, so let’s go!

Not so fast. What if rents don’t climb at your projected rate. What if cap rates rise. What if an employer lays off and vacancy rises. What if renovations cost more.

Or flip it around. You have a screaming deal but you’re going out of your way to be conservative. You’re presenting good returns but if rents grow like they’ve grown over the last couple of years and vacancy rates remain stable, you’ve got a home run! How do you show this?

What if, what if, what if …

Take the time to enter alternative data in your model. Rent growth less than conservative. Super conservative. A cap rate when you sell that’s a half to a full percentage higher than what you’re modeling. Vacancy three to five percent higher.

And make several variations on these. It’s very easy to do in most underwriting spreadsheets, but just takes time. Investors want to see these, and will appreciate that you went the extra mile to show it.

If your deal just won’t work when the numbers are stretched, then it doesn’t work period. Recognize that and make the tough decision to pass on it if you need to. The only certainty in multifamily investing is uncertainty.

No projection ever came out correct, but you can plan today for outcomes that are less than favorable. Rents slowed, vacancy higher but returns are still decent? Awesome, it passes.

Here’s another way to build in sensitivity analysis. Excel has a feature called What-if Analysis, found in the Data tab. Take time to learn about it. You can Google terms like “building an excel data table”, also add “one variable” or “two variable” or “building an excel data table across worksheets”. I’ve seen some very clear explanations that should help anyone with good Excel proficiency create sensitivity tables.

Here’s an example, where the green highlighted number is what you are projecting but the other numbers around it are what might happen.

Many commercial underwriting templates have this feature built in but it’s good for you to understand how they work, what’s going on behind the scenes. For your investors to trust you and your numbers, you need them to know you understand where your numbers came from. When you can explain them clearly, they’ll know you understand them.

“Torture numbers, and they’ll confess to anything”

– Gregg Easterbrook